We'll shop for you and provide multiple insurance quotes

We can help you get insurance rates for a variety of auto services

Our team of insurance experts specializes in working with companies in the auto industry - just like you

Collision Repair

Car Wash

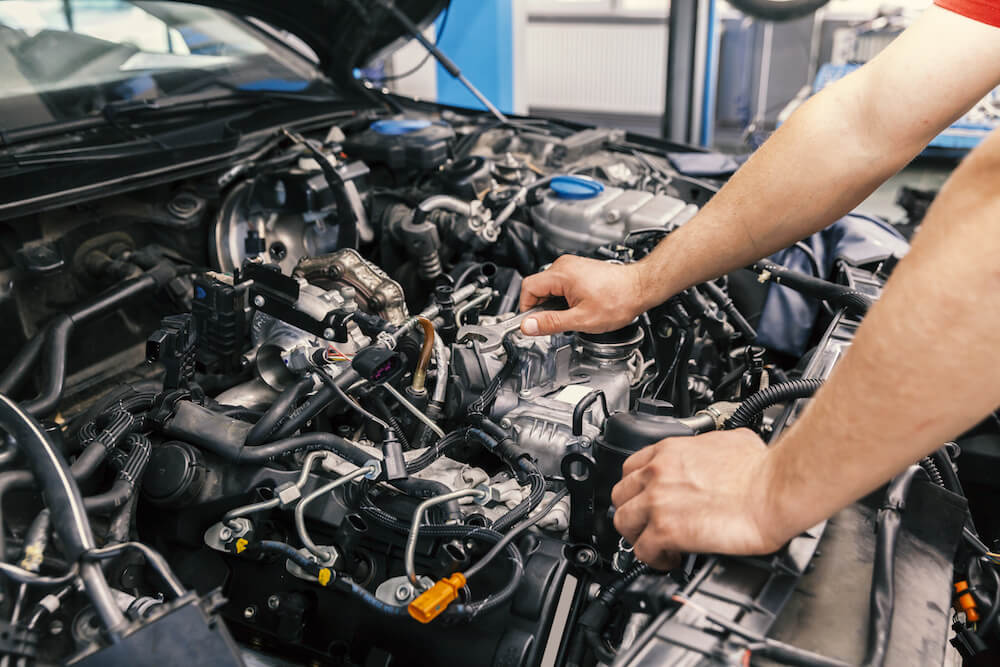

Auto Mechanic Shop

Auto Detailing

Auto Glass Repair

Transmission Repair

Brake Installation/Repair

Oil Change Shop

Emissions Testing

We provide multiple insurance quotes to compare for businesses just like these and many others. Get started now!

How much does auto repair shop insurance cost?

You’ve probably got a lot of questions about your auto repair shop insurance, and one of the biggest questions weighing on your mind might be this: how much does auto garage insurance cost? To get the most accurate idea of how much it will cost to insure your unique business, it’s best to go ahead and get some auto shop insurance quotes. Many different factors play a part in what your insurance will cost. You might be a little intimidated by the idea, but we want to make insurance as easy as possible.